Residential LBTT Up Year-on-Year But Future Outlook Uncertain

Like the rest of us, the Scottish Government’s property tax (Land & Buildings Transaction Tax, or LBTT) has had a bewildering last few months. This Briefing looks at the residential part of LBTT based on housing market transactions.

Ostensibly, things look positive - in 2019/20, the number of LBTT returns reached over 105,000, up from just under 104,000 for the same time a year earlier; an increase of 1.2%. The total value of LBTT tax revenues to 2019/20, excluding its sister tax Additional Dwelling Supplement (ADS), totalled £288 million, 10% up on the previous year. The greater increase in revenue, ahead of transactions, reflects the flattening of housing market activity over 2019/20 while prices continued to rise. As the new tax year started in the shadow of the Covid-19 lockdown, the outlook for LBTT revenue in the coming years is highly uncertain and looks likely to be significantly down.

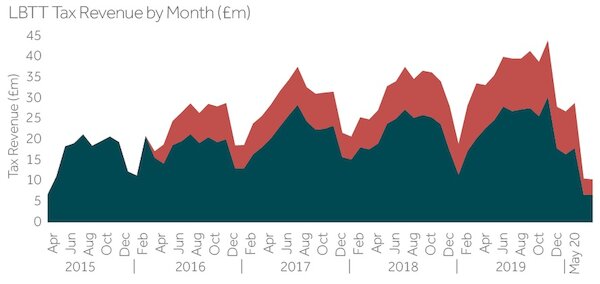

In broad terms, rising house prices and transaction activity in the past few years have supported rising LBTT revenues for the Scottish Government.

Fig.1 LBTT & ADS revenue had been rising due to price & transactions growth

Fig.1 LBTT & ADS revenue had been rising due to price & transactions growth

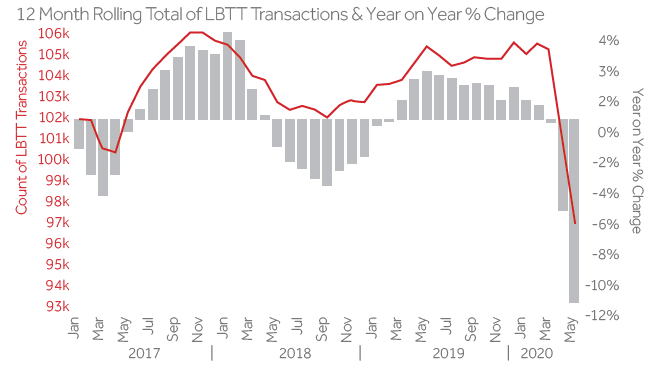

However, this growth has not always been consistent as political factors, such as Brexit, have impacted on market sentiment. Fig. 2 shows the year-on-year fluctuations in LBTT transactions and revenue. There was already a slowing down in transaction numbers from the end of 2019, which turned negative at the start of 2020.

Fig.2 Annual growth in LBTT transactions turned negative in March 2020

Fig.2 Annual growth in LBTT transactions turned negative in March 2020

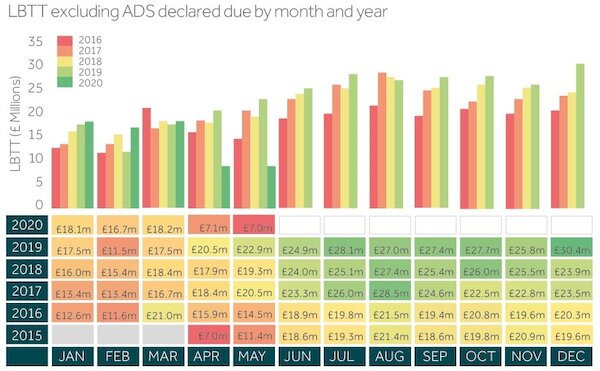

With the latest figures now reported, we can see the first impacts of the Covid-19 lockdown, with overall revenues for April and May down c.67% on the year before (Fig.3.). With the housing market effectively closed during April and May, it would be expected any revenues will be minimal for what is usually the buoyant Spring market. It will be difficult for 2020/21 revenues to recover all ground lost after this despite the recent announcement of the recent LBTT holiday which we reflect on later in this briefing.

Fig.3 LBTT revenue in April / May 2020 was down-67% year-on-year as a result of Covid-19

Fig.3 LBTT revenue in April / May 2020 was down-67% year-on-year as a result of Covid-19