Sales market maintains stability.

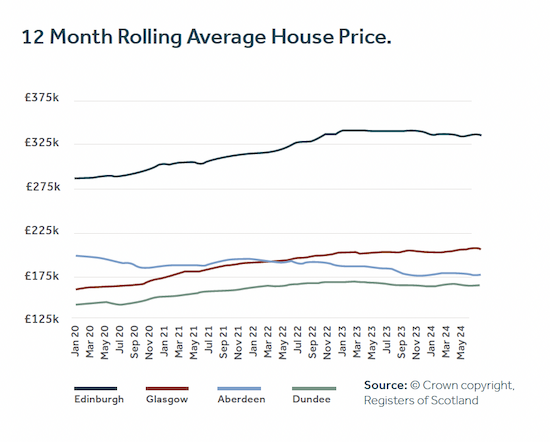

On a 12-month rolling basis, average prices across Scotland have plateaued since late 2022. This followed two years of moderate rises (2021–22). Growth has stopped due to rising mortgage rates.

Aberdeen is the exception to this general picture as the city has seen a slow decline in average prices since 2015, when the oil price collapsed. However, even in Aberdeen, prices now seem to have stabilised.

Average house prices stabilised from late 2022.

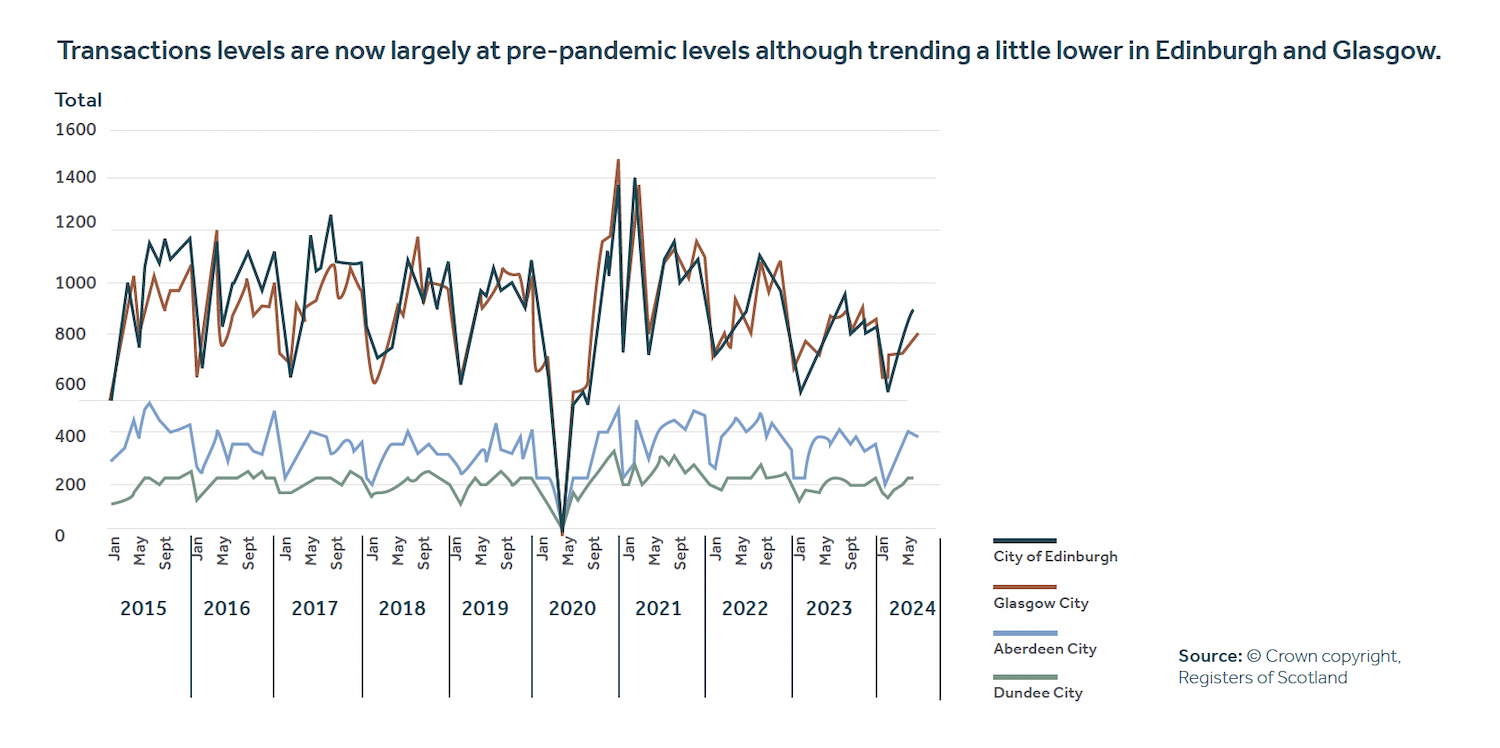

The number of house sales has followed a similar pattern across different parts of Scotland.

- In the years before the pandemic, there was a fairly steady seasonal pattern to sales, with the national market ticking along at around 100,000 annual transactions.

- The pandemic then caused a slump and a bounce-back.

- Since then there has been a return to pre-pandemic patterns, although the most recent data shows that sales in Scotland’s two main cities (Edinburgh and Glasgow) seem to be edging down below pre-pandemic volumes.

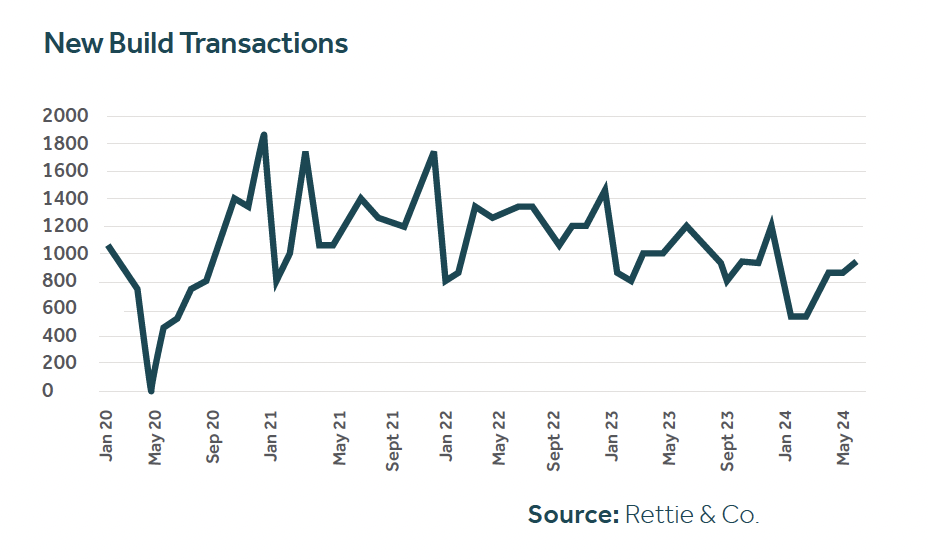

New build sales continue to fall.

The new build market has endured a sustained period of challenging conditions. Demand has been suppressed by rising mortgage rates, while rising labour and material costs have slowed down delivery of new homes.

From late 2020 onwards there has been a notable downward trend in new build sales.

- In the last year, sales volumes are down over 20% across Scotland.

- New build sales have only accounted for 11% of all Scottish sales in the last 12 months (this figure is normally around 15%).

This is in contrast to the largely stable pattern in the overall sales market.

The average price of a new build in Scotland has continued to rise and is now around £324,000 (up 2.2% in H1 2024, compared with the same period last year). However, incentives are commonly being used at around 4–7% of gross sales prices. This means that, in net terms, new build prices are likely to be actually falling in most locations.

Compounding the problems cause by current economic conditions, the new National Planning Framework (NPF4), introduced in February 2023, continues to spread uncertainty around the new build market.

New build sales have been on a clear downward trend in the last two years.

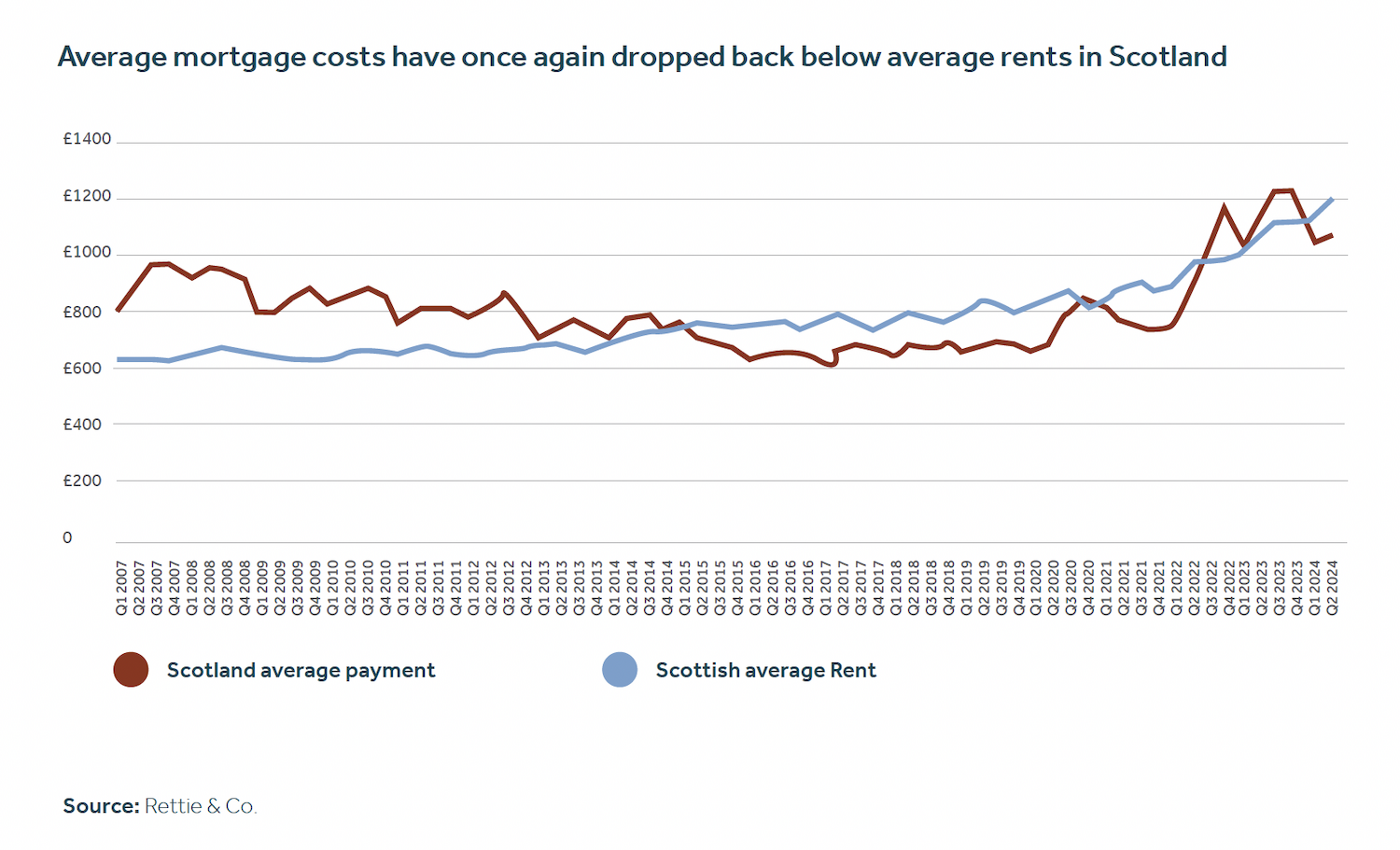

Mortgage affordability improves.

For much of the 2015–22 period, house buying was more affordable than renting, with the cost of mortgage payments (based on average 2-year fixed rate mortgage at 85% loan to value) below that of the average rents. Sharply rising mortgage costs from Autumn 2022 reversed this position. This provided greater incentives for many people, especially first-time buyers, to rent rather than buy.

Recently average mortgage costs have dropped back again. They have now fallen below average rents, which have continued rising. This is providing a renewed incentive for first-time buyers to make the move into property. Given that first-time buyers are the lifeblood of the sales market, this reversal is encouraging.

Average mortgage costs have once again dropped back below average rents in Scotland.

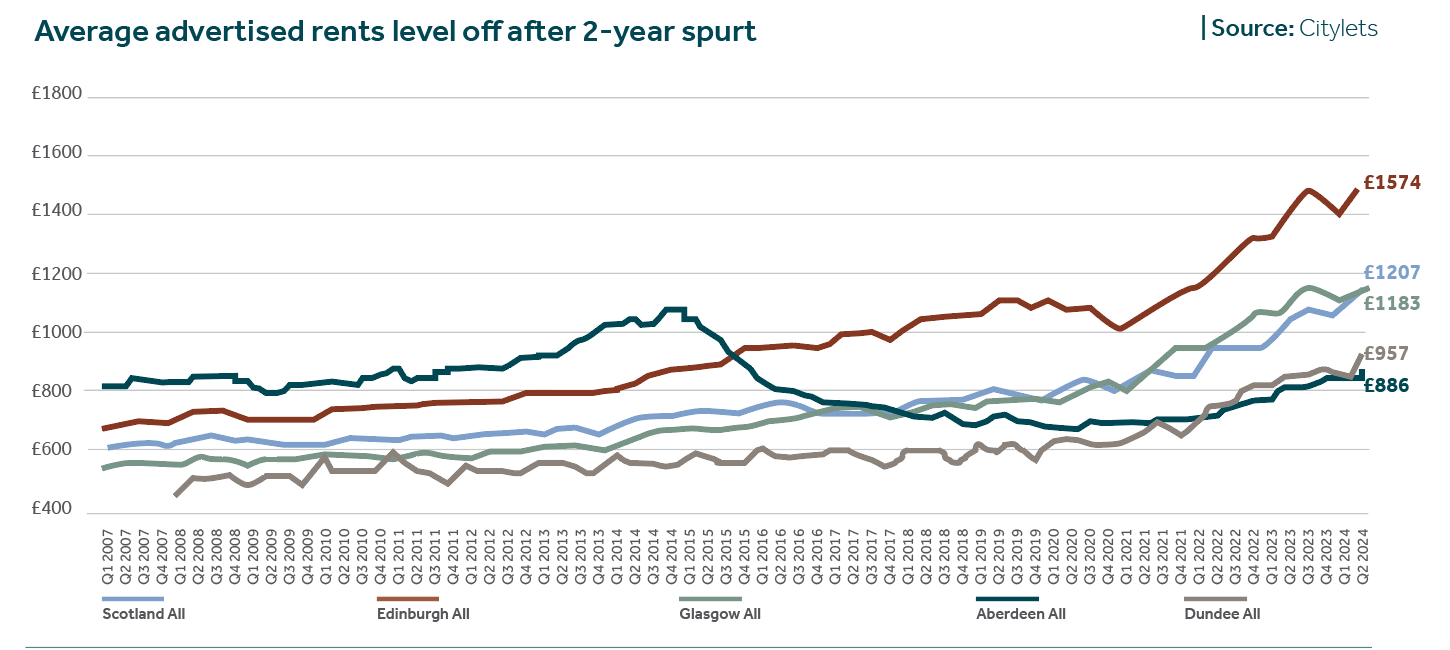

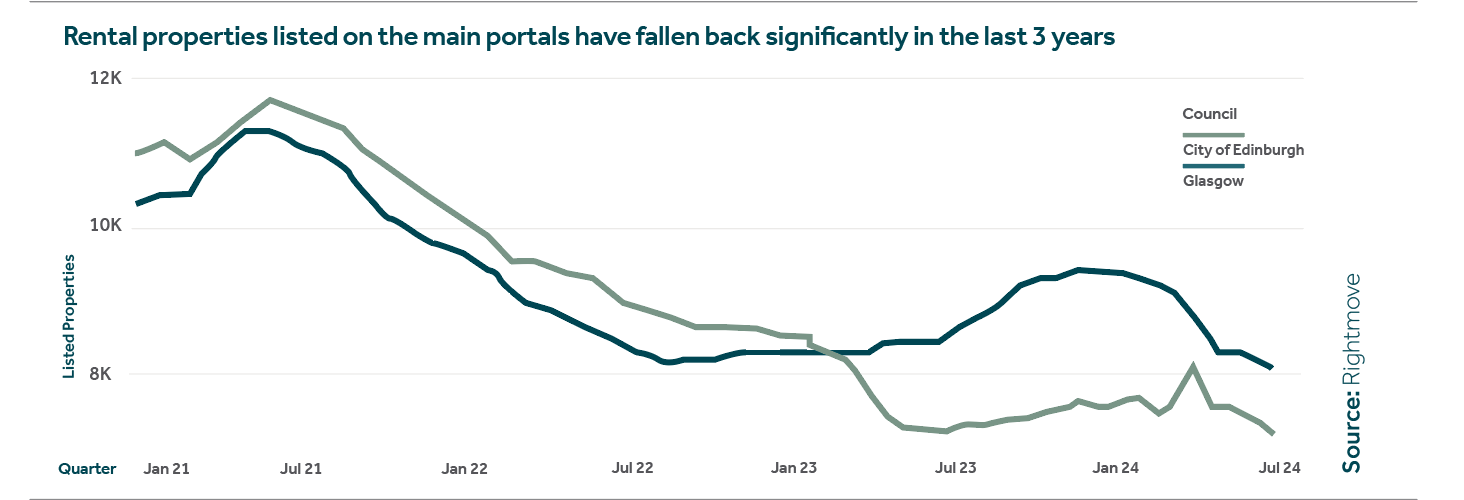

Tighter supply drives the cost of renting upwards.

Average advertised rents (new rents between tenancies) in the private rented sector (PRS) have now cooled after a 2-year spurt. This spurt was caused by a growing demand/supply imbalance in the sector, and by the unintended consequence of the Scottish Government’s rent freeze/cap that operated over this time. This cap froze rents within tenancies but not between them.

It seems clear from the current evidence that rental availability has now dropped back drastically. As demand is on the rise, this has led to rent pressures. The Scottish government’s proposal to deal with this issue is to bring in a strict rent control regime (to be managed by local authorities). This proposal is contained in the new housing bill that is now working its way through Parliament. The government does not seem to recognise that this will, in all likelihood, have the unintended consequence of further squeezing supply and leaving many tenants unable to find a property to rent.

The housing bill has also deterred build-to-rent (BTR) investment, which is capable of producing significant levels of new supply. There has, unfortunately, been virtually no investment of this type in Scotland since the rent freeze was first announced in Autumn 2022.

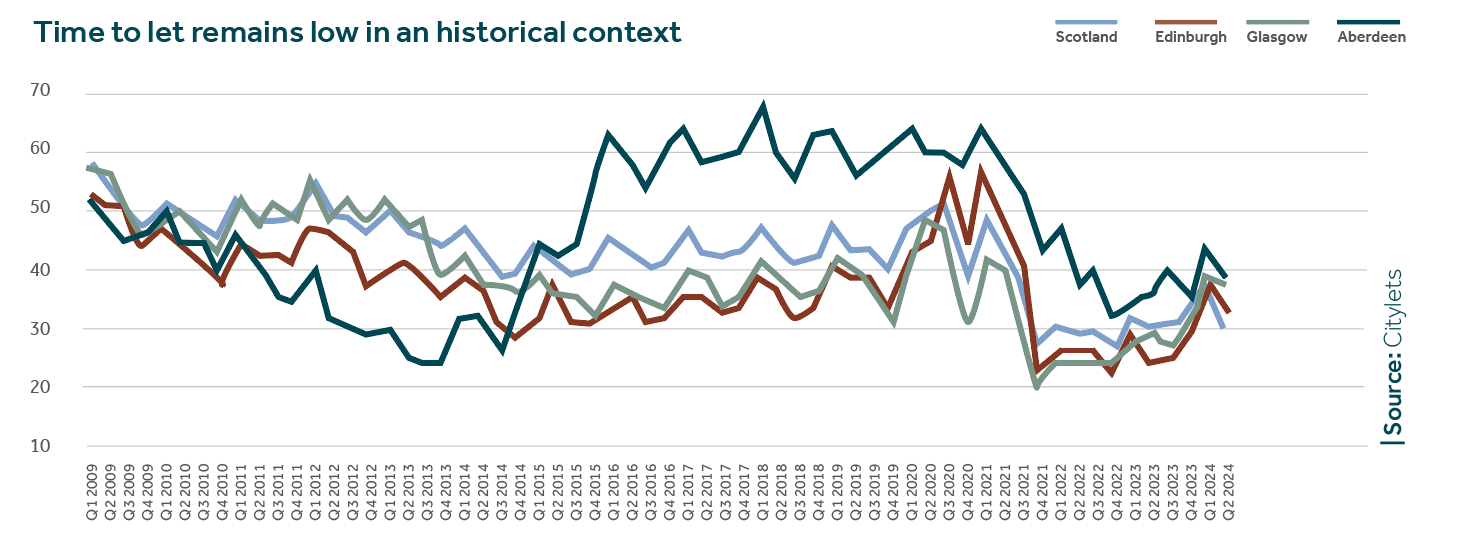

The time taken to let a rental property in the PRS remains at historic lows. The Scottish average has stood at around 20 days for the last few years, when it was previously around 30 days. It should be noted that, in the main cities, time to let has risen slightly as market pressures have reduced a little.

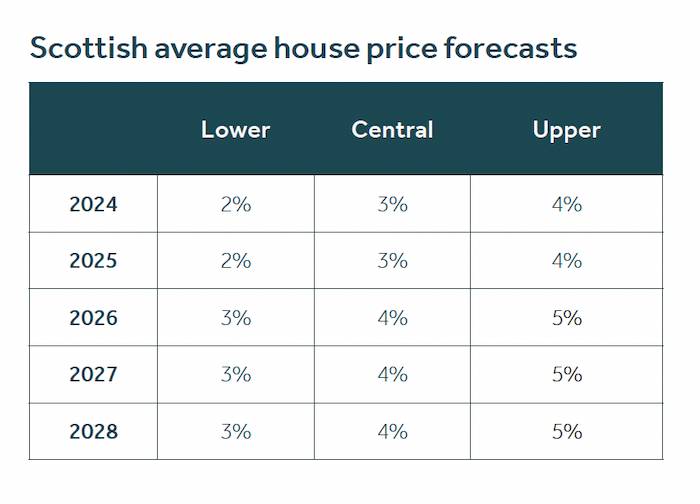

Our Market Outlook and Forecasts.

While mortgage rates are now reducing, they will remain above historic levels for a time, which will mean that the market will still face a headwind. This is likely to exert continued downward pressure on the overall average price across Scotland. This is despite the fact that demand remains active, although it is considerably weaker than it was in the period from 2021 to mid-2022.

In our central forecast, we expect average prices to rise this year by around 3%. This is slightly up on the forecast we made at the start of 2024. For 2025, we have revised down our forecast to 3%. This is due to the sluggish economic performance that is anticipated. In subsequent years, we think that growth will then move back closer to the long-term trend (of around 4%) – if the economy recovers as anticipated. However, it will take time for the whole market to adjust to higher interest rates, as people gradually come off fixed-term deals. This will probably suppress average house price growth for a time.

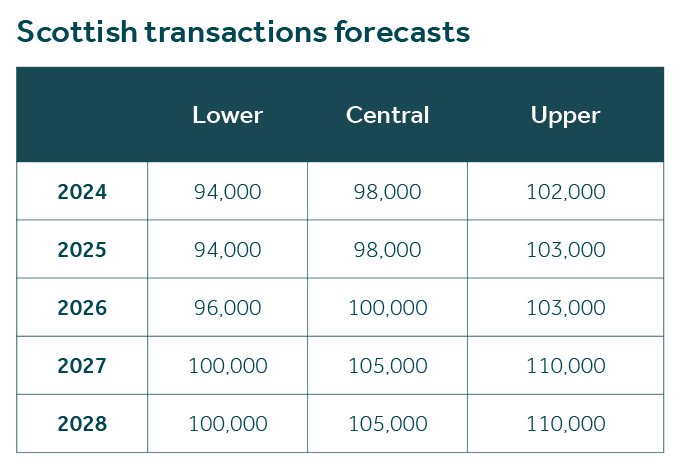

Sales activity is stabilising and starting to recover, albeit slowly. Transactions were around 93,000 in 2023 and we believe that this will increase modestly this year. We also think there will be a gradual movement towards a longer term trend of c.100,000 sales per year as economic recovery becomes more established. However, this will vary across geographies and property types. To give some context, Scotland achieved 154,000 sales in 2007 at the market peak, a level that we are unlikely ever to return to.

In terms of the rental market, we think that some of the pressures on the PRS will ease as demand dampens a little (due to the cost of the average mortgage falling below the average advertised rent). This is already being seen in the main cities, although sharper reductions in supply may increase pressures again, especially if the problems presented by the new housing bill are not addressed.